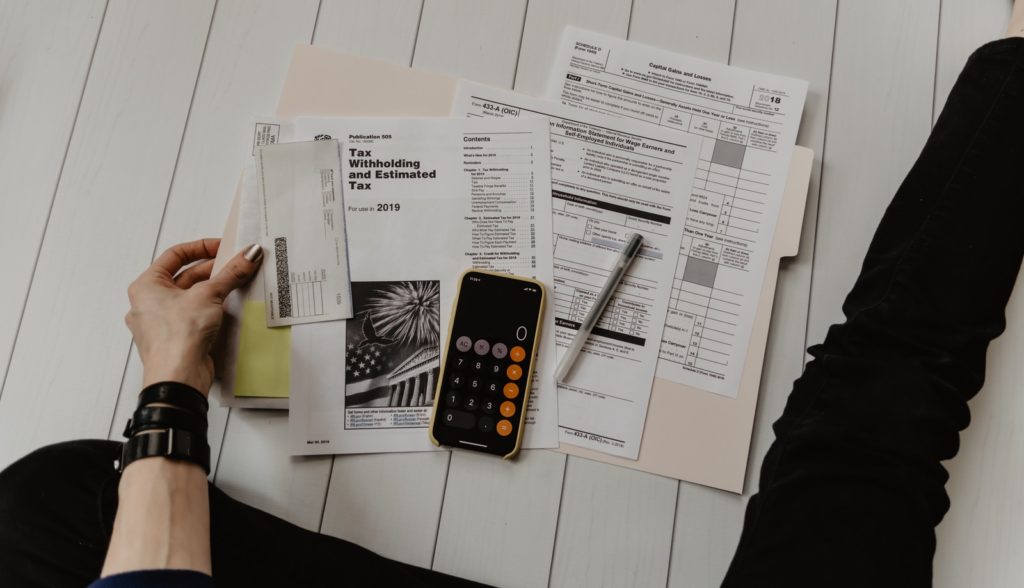

A Sage survey revealed that 83% of accountants agree that investing in the latest technologies and digitalization is necessary to keep up with the market.

Landlords already have numerous tasks to undertake each month, so they must know how to manage bookkeeping effectively and know the best technologies to assist with their monthly bookkeeping tasks.

Are you looking to gain more knowledge of the bookkeeping process for landlords? Keep reading for a guide to bookkeeping for landlords that will help you streamline, organize, and automate bookkeeping processes, allowing you to focus on more important tasks like growing your business and retaining tenants.

What is Real Estate Bookkeeping?

The bookkeeping process for landlords involves managing assets, liabilities, income, and expenses. The effective management of transactions is essential to good bookkeeping practices. The bookkeeping process generally consists of the management of the following transactions:

- Invoices sent to tenants

- Monthly rent receipts

- Late payment fees charged to tenants

- Posting tenant security deposits to balance sheets

- Responding to vendor invoices

- Monthly mortgage payments

- Setting funds aside for interest and principal loan balance

- Making property tax payments

- Homeowners Association fees

- Reconciling monthly financial statements

- Classifying payments as deductible or capital

- Tracking accrued depreciation

- Reporting owner equity

Monthly rent receipts should contain information regarding the tenant’s name and address, the payment method used, the amount of rent received, the rent payment period, and any late fees or remaining balance due. As with all other expenses and transactions, you should post rent receipts on the transaction date.

Keeping receipts and leaving a paper trail will ensure that your landlord business can verify all income and transactions if selected for a tax audit.

Real Estate Bookkeeping Methods

One can choose from several methods when considering how they should best navigate their bookkeeping processes. Each technique comes with its benefits and drawbacks. The primary bookkeeping methods include:

- Spreadsheet software – spreadsheet software allows landlords to perform their bookkeeping on a free platform. For experienced financial analysts and accountants, Excel and other spreadsheet software allow for data insights using formulas and deep analysis. There is a wide range of free templates available. One of the drawbacks of excel is that it is difficult to automate processes without coding knowledge.

- Bookkeeping software – one of the significant advantages of using bookkeeping software is that software developers have created it to help anyone perform bookkeeping tasks with ease. Bookkeeping software is intuitive and comes with onboarding tutorials, live helpdesks, and tools to assist users in their bookkeeping practices. The software can automatically generate reports to make bookkeeping processes faster and easier. However, for particularly adept financial analysts and bookkeepers, bookkeeping software may not provide enough autonomy to the user and the freedom to code automation for personal use.

- Rental-specific accounting software is a similar method to using bookkeeping software; only it is directly tailored to cater to the needs of real estate investors and landlords.

The method of bookkeeping you use for your landlord business is entirely dependent on your individual expertise and preferences. If a solution isn’t working for you, this may indicate that it’s time to try a different method.

The Benefits of Effective Bookkeeping For Landlords

There are many benefits to implementing an effective bookkeeping strategy for landlords, and this section will cover some of the main reasons bookkeeping should be a high-priority consideration.

Bookkeeping is an essential business practice that allows for data analysis to help the business grow. Here are some of the main advantages you will gain from effective bookkeeping practices:

- Up-to-date and detailed records – having detailed and up-to-date records will allow for better supervision of your landlord’s business finances. They will also allow you to speed up the auditing process should your business be selected.

- Legal compliance – if you and any of your employees or accountants manage bookkeeping processes effectively, you should be able to keep up with any legal changes and ensure your bookkeeping practices are compliant with these changes.

- Better planning and forecasting – if you have accurate records of your business expenses and income, it is easier to come up with accurate forecasts and predictions for the future.

- Instant reporting – having the latest reports on your landlord business’ finances can allow you to instantly understand your financial situation without having to wait for your accountant or employees to generate reports manually.

- Better tax processes – you will be able to predict your tax outcomes more accurately with detailed reports of your company’s finances. By hiring a professional accountant, you can even make savings on taxes, too.

Transaction Types

To fully understand the bookkeeping process for landlords, it is beneficial first to understand the types of transactions that you will record in the bookkeeping process for landlords and property investors.

There are many different transaction types, and each transaction type links to either your business, your property, or one of your tenants. Knowing how each transaction type relates to your business can be highly beneficial and help you manage your transaction records better. Here are some of the transaction types you must be aware of:

- Tenant income – income relating to tenants generally includes tenant late fees, tenant rent payments, tenant deposits, and tenant parking fees.

- Tenant expenses – a tenant expense would usually include an incident where the tenant must reimburse the landlord for damage to the property.

- Property income – application fees, reserve funds, and other fees collected.

- Property expenses – expenses relating to the property might include maintenance and vendor payments, building utilities, and property management fees.

- Business income – income relating to the business includes tenant late fees and management fees.

- Business expenses – fees relating to property management software, accounting software, legal services, etc.

Bookkeeping Tips For Landlords

Here are some general landlord bookkeeping tips designed to ensure your financial data is accurate and straightforward to manage.

Separating Personal And Business Accounts

Landlords who only manage and rent out one property often think they do not need to separate their personal and business accounts. However, housing both personal and business transactions under one account can make reconciliation processes more difficult down the line.

Instead, it would be more beneficial to open separate personal and business accounts to keep all transactions separate. To access their earnings, landlords need only pay themselves from the business account when they are ready.

For those who manage the expenses for multiple properties, particularly many multifamily housing properties, it can be beneficial to open separate accounts for each property to avoid confusion.

For property managers, it is crucial to understand that commingling your and the property owner’s expenses is illegal, and both should be housed separately in different accounts.

Utilizing Property Management Software

Property management software, like the platform Landlord Studio, allows you to unite all property management functions on one user-friendly interface. To keep better records of tenant payments, landlords can establish online portal payments and make this the primary payment method for all tenants. Handling charges from different sources can inhibit organized processing.

For instance, it may be difficult for landlords to keep track of payments that are in cash, by bank transfer, or by cheque. Instead, it would be easier for landlords if all tenants made their payments using the same method, as property management software stores all payment information in one place. For this reason, using property management software can seriously enhance the efficiency of your bookkeeping practices.

Establish A Reconciliation Plan

Recording transactions is only half of the bookkeeping process. The other half of the process is reconciling accounts to ensure the financial reports are accurate and you and your employees have logged information correctly. Reconciling your books is a monthly task, and you should set aside time each month for this process. Reconciliation takes longer with the larger and more complex expenses portfolios.

Software developers have created bank synchronization tools to assist in the process of reconciliation. Rather than correlating data from two different sources manually, bank synchronization allows landlords to automate the comparison of data entries in your bookkeeping software and the data in your bank transactions.

If you perform verification on data entries weekly, you can significantly reduce the time you must spend on reconciliation each month. Simply place a tick in the checkbox next to each transaction to verify that it matches your bank statements. You will be able to chip away at the overall reconciliation process throughout the month.

Hire A Professional

Bookkeeping is difficult, and landlords should not hesitate to hire external help to lighten their workload. Becoming overwhelmed with financial management will not allow landlords to grow the business and concentrate on property supplier trends. So, if bookkeeping isn’t in your wheelhouse, don’t hesitate to opt for external help that will prevent mistakes from being made.

Summary

Bookkeeping is a considerable undertaking that can occupy many landlords’ time. Since landlords often have many other tasks to oversee throughout each month, it is essential to utilize all the tools, tips, and tricks available. Saving time on bookkeeping practices allows landlords to shift their focus towards growing the business, improving their properties, and ensuring their tenants are satisfied to encourage tenant retention.